The ANU Tax Clinic is self-funded by the ANU (Research School of Accounting, CBE). We have now completed our 5th year of operation with outstanding success, generating over 800 requests and completing 509 appointments in 2023.

The ANU Tax Clinic operates on a unique model. We educate and guide clients to finalise their own tax returns rather than acting as their tax agents. By empowering our clients, we aim to help them engage with the Australian tax system more readily. In 2023, we had 20 tax professionals volunteering to assist our students with this aim. They attend each appointment with the students and provide supervision and mentoring for each student.

We had 26 volunteer tax students and interns working with the ANU Tax Clinic in 2023. Almost all of the students finishing their studies this year were able to secure positions within the tax or accounting fields – some receiving multiple offers. Students who are continuing their studies in 2024 have opted to continue to volunteer with the ANU Tax Clinic and will continue to gain valuable work-ready experience.

In 2023, the tax clinic experienced significant growth in both the number of appointments and workshops conducted. The clinic maintained its established blended delivery format, with approximately 66% of appointments conducted face-to-face at the ANU Tax Clinic Hub with the remainder being via phone or video conferencing.

The ANU Tax Clinic operates from April to October each year with early appointments in March for extremely vulnerable clients. Appointment requests continued to grow exponentially by 57% from 511 in 2022 to 803 in 2023. The number of appointments continues to grow as show below.

Yearly growth

2023 saw 9 Tax for Beginners workshops for high school students and several business tax workshops (including 3 for Indigenous organisations).

Our clients included several different types of structures, including 26 small businesses, 137 sole traders and 694 individual employees.

And came from both metropolitan and regional Australia:

National appointment request distribution

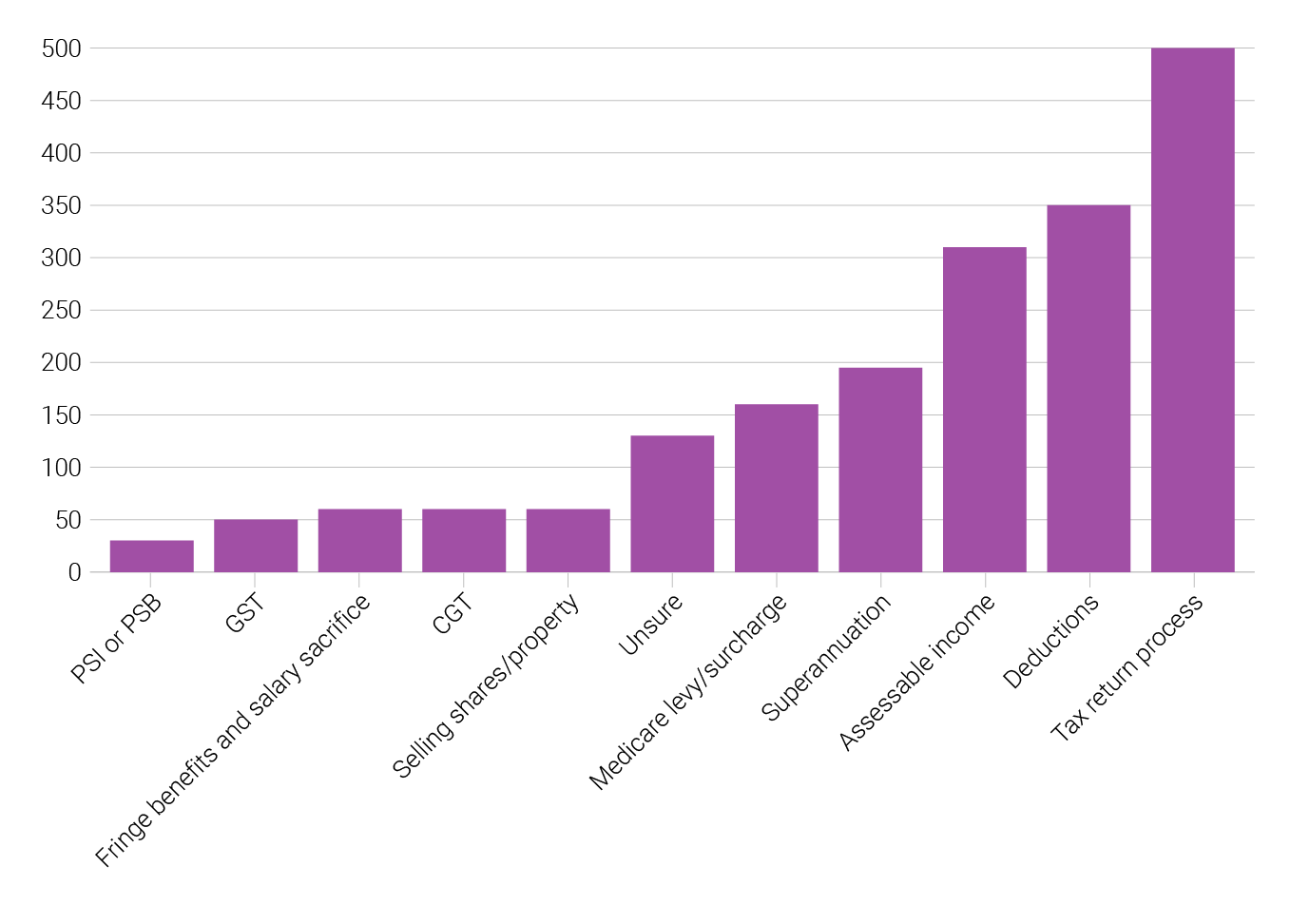

2023 had a good mix of complex and common tax questions. Similar to previous years, queries coming through during tax season were mainly based on common issues such as how to file taxes, income, deductions etc. However, there has been an upward trend in requests for appointments relating to information on foreign income. The ANU Tax Clinic covered issues on foreign income from USA, England, Thailand, Myanmar, Germany and Canada just to name a few (only covered Australian tax implications due to our student focus).

Overall, 2023 was a highly successful year for the ANU Tax Clinic.

Tax issues faced by clients